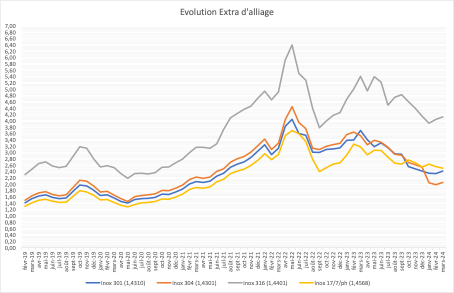

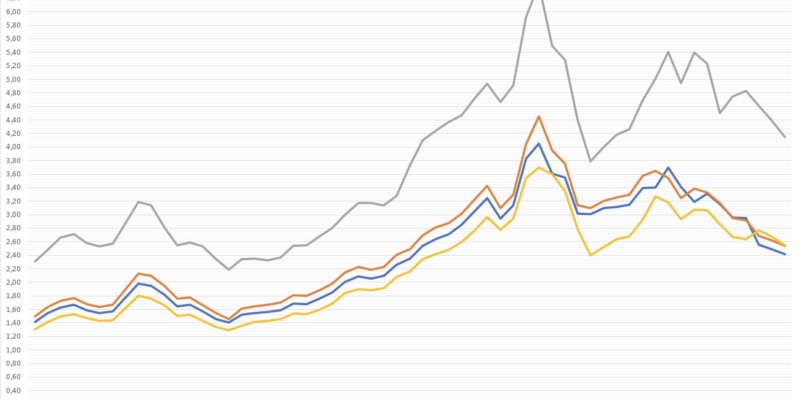

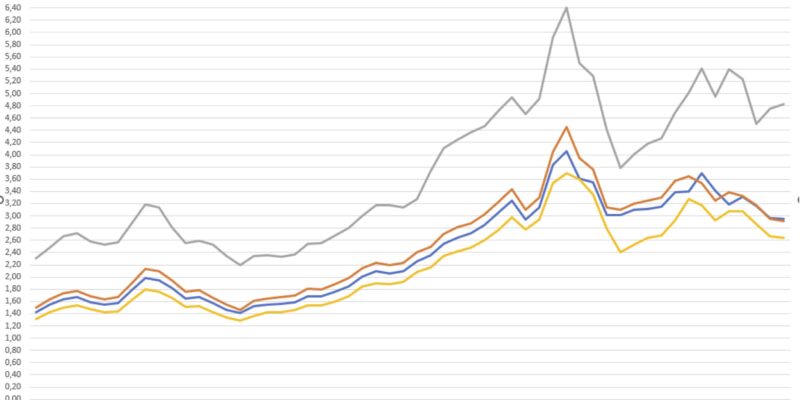

Although a slight recovery in steel prices seemed to be taking shape in the fourth quarter of 2023, it has not yet really materialised. The economic outlook in China remains weak, which also has an indirect effect on steel prices in Europe.

In Europe, the German market remains very weak, with an overall decline of 5% compared with the same period in 2023, due in particular to a fall in the automotive market. This decline could reach 25%.

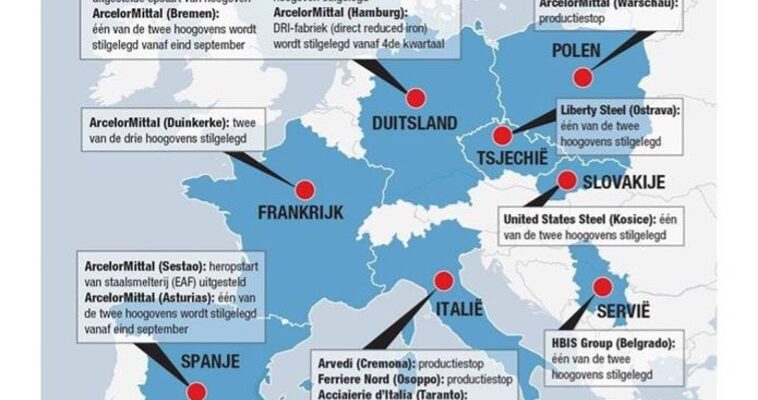

As demand remains weak, pushing prices down – despite a small increase of 40/tonne in March – there will continue to be a risk of steel mills closing capacity in order to maintain a certain price level. This type of closure is obviously likely to handicap a future recovery in the event of a sharp increase in demand.

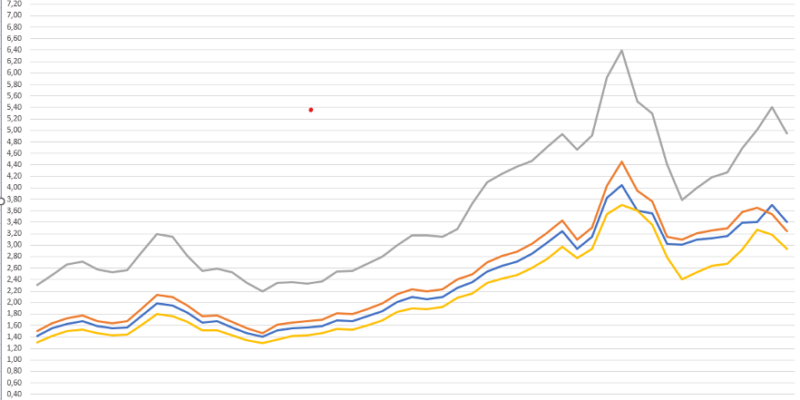

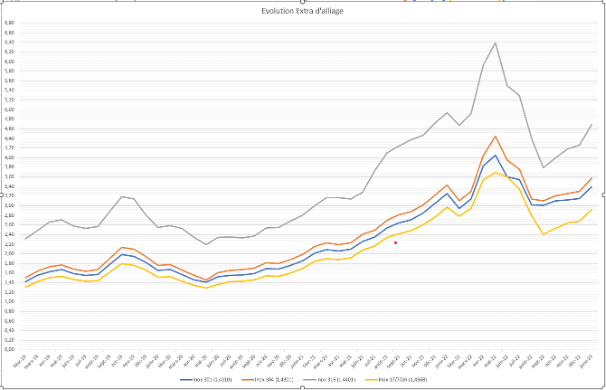

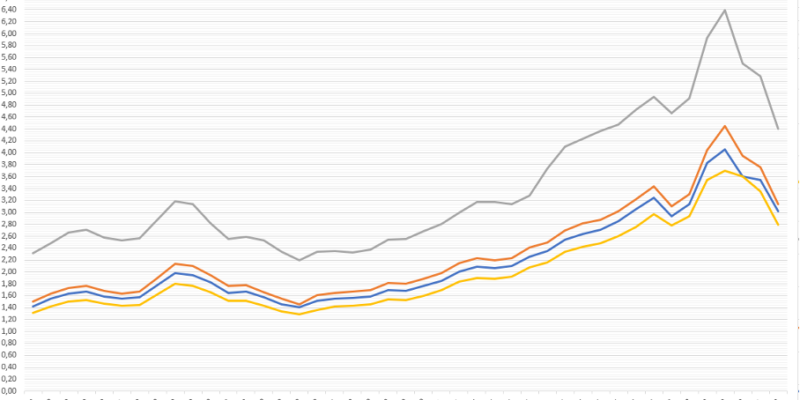

Against this backdrop, steel and stainless steel prices have remained stable at very low levels. Alloy surcharge prices followed the same trend, with a slight upturn in March.