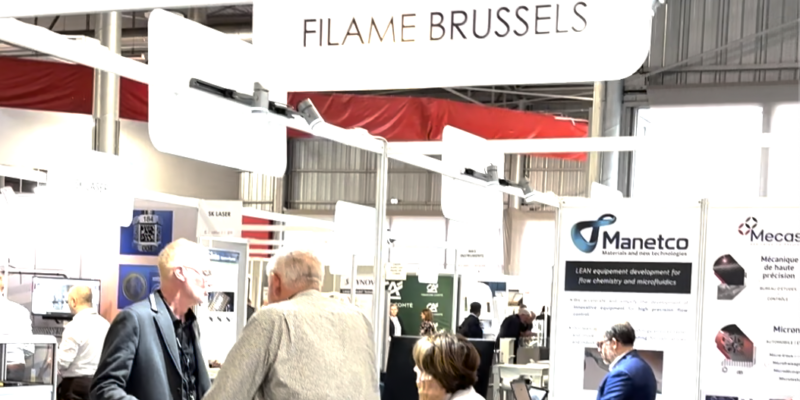

Filame will be taking part in the Salon Global Industrie in Paris from 11to 14 March 2025.

Together with the Hanover Messe (31 March – 4 April 2025 – which Filame will also be attending), Global Industrie is Europe’s largest trade fair for industrial subcontracting.

Filame will be delighted to welcome you to its Stand 6M145 in the metal forming village.

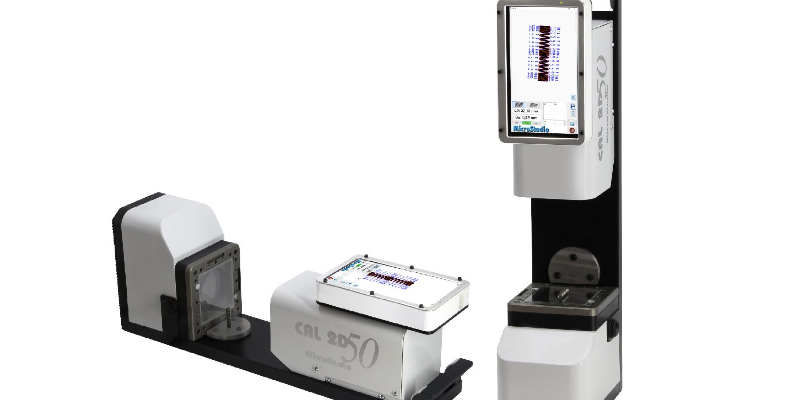

Come and discover our know-how.