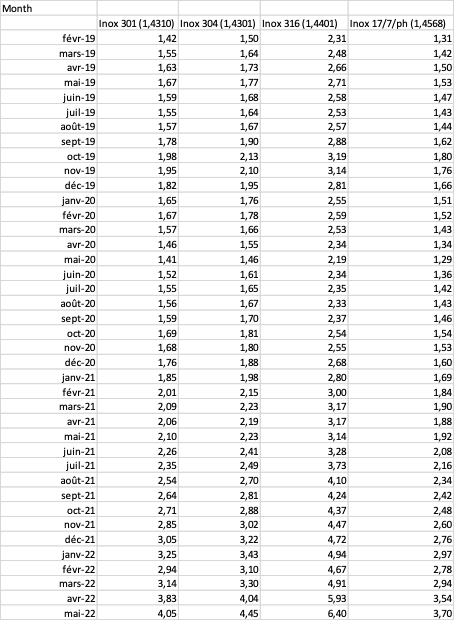

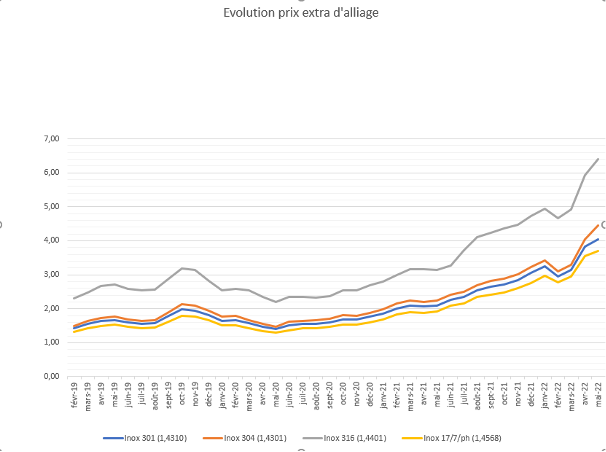

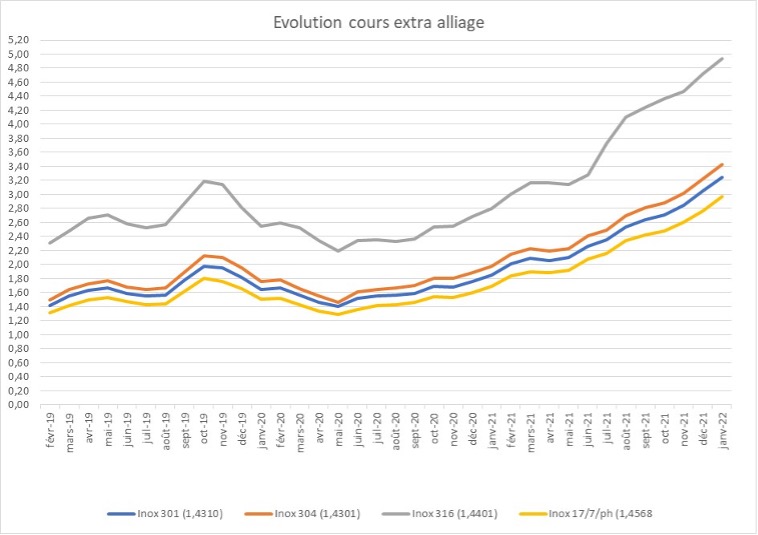

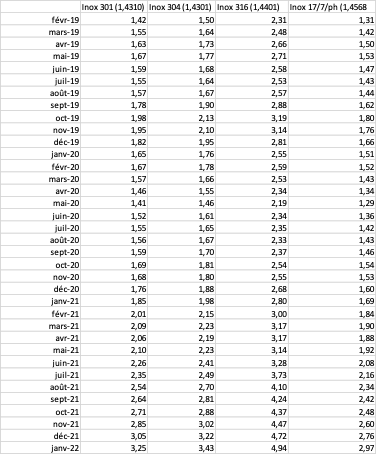

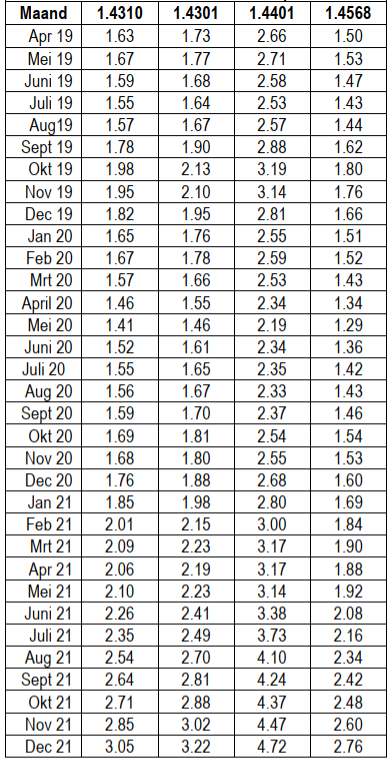

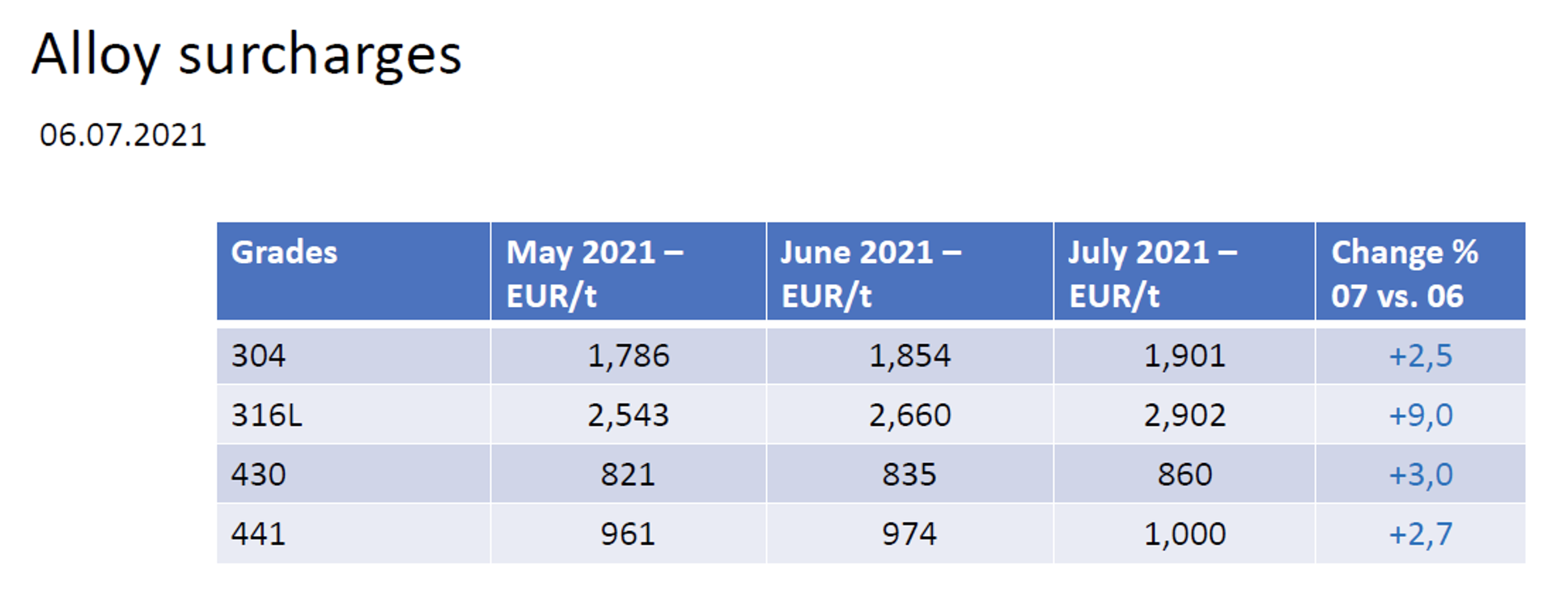

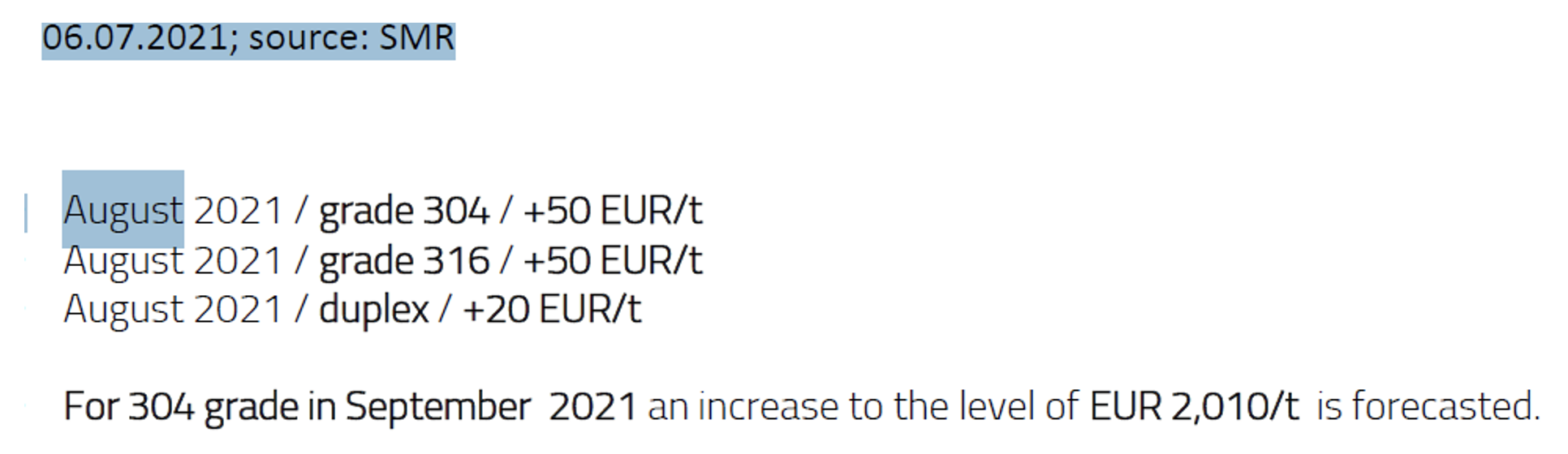

As the Filame Group does every month, we have consulted our panel of suppliers in order to estimate as accurately as possible the development of the price of the alloy surcharges for the stainless steels that the Filame Group uses on a regular basis.

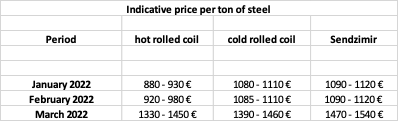

For the month of May, there was a very significant increase, sometimes of more than 10%, for the various alloy surcharges.

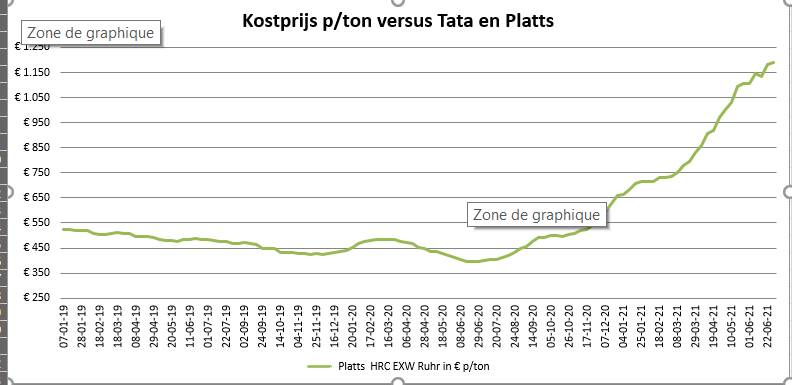

Tensions in the markets have not calmed down and international events, especially the war in Ukraine, which has become a long-term problem, have not really evolved.

It should be noted that all suppliers also apply an energy surcharge of up to €120/ton to account for the increase in energy costs. This surcharge is in addition to the energy surcharge of about 250 euros/ton that has been effective since the beginning of the year.

Filame recalls that the price of the alloy surcharge is set from month to month by the various suppliers according to the quality of the stainless steel they supply. Thus, there may be differences among the various suppliers, but the trend is the same among all of them.

Moreover, the applicable price is the one on the day when the material is delivered. Therefore, there may be variations in these pices between the time of order and the time of delivery, especially since delivery times are still very long.

Filame therefore draws the attention of its customers to the fact that, if necessary, depending on changes in the price of materials and the time of delivery thereof, it may have to adjust the prices of current quotations/orders versus the time of the quotation/order itself.

The price of alloy surcharges