Filame will be present at Advanced Engineering, the leading exhibition for innovation in the Belgian manufacturing industry, on May 11 and 12, 2022 in Antwerp.

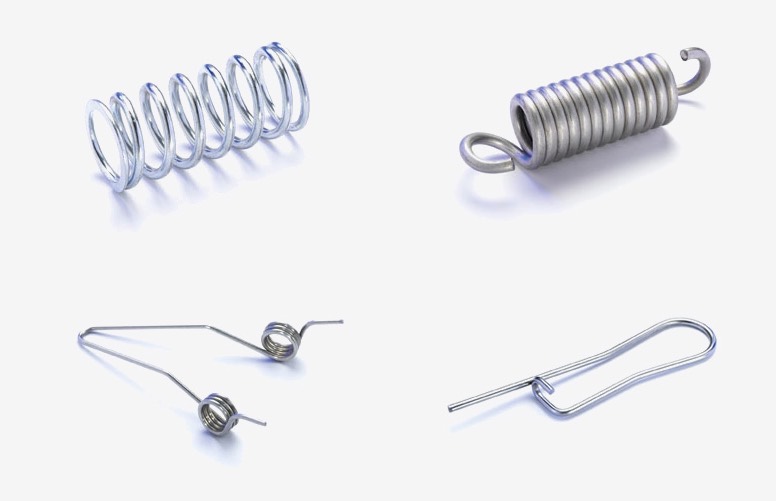

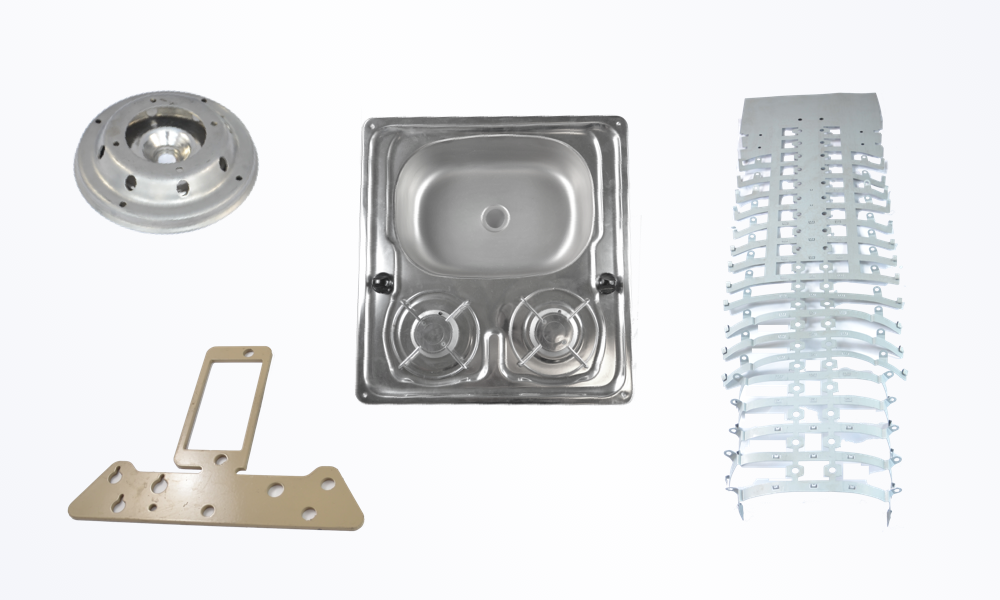

You will discover the current trends and the latest topics in the field of product development. Filame will be exhibiting its know-how in the manufacturing of metal parts out of wire and strip.

Come and visit us at Antwerp Expo (Jan Van Rijswijcklaan 191 – Antwerp), booth 149